Award-winning PDF software

Miami-Dade Florida Form 888: What You Should Know

Pursuant to Chapter 319, Florida Statutes, this form is to be used by financial institutions and other Lien holders on all non-payments made by non-credit cards for the first three consecutive months in which payment was made in full. [F.S. 319A.053(3)] The owner of property is responsible for the payment of all liens and other charges on it. By accepting a lien, the owner agrees not to apply any amount of payment made for the property until all liens are satisfied. The owner is responsible for paying for lien removal and the costs of any action taken to prevent the lien from being enforced. Payment to prevent the lien becomes due when the lien attaches. The holder of a lien has the same right and duty to recover damages as the title to the property holder. “The only thing they can do is wait and see if the courts will allow them to put liens on your land” The process is not over and your lien is not removed until the court allows the issuance of a lien and judgment is entered against you under Florida law. To prevent title damage, the holder of a lien is required to notify the owner of the lien immediately after a sale or transfer by first class mail to the last known address on file with the Florida title department. The lien holder is also required to send a notice of the lien to the owner of record and to send written communication to a Florida title company regarding the lien and notice of the lien to any Florida title company not specified in the notice of lien. The lien title company must receive all such communications within ten days of receipt or the lien title company shall send a notification to the lien holder as provided in this chapter. In lieu of written notification, the lien holder is required to provide notice of the lien to the address indicated on the title to the seller or transferee listed on the deed. A notice sent to less than the last known address on record shall contain such notice as the lien holder may dictate, but its content shall not exceed three lines and one-half (3/2) of the page or less. Notification to the last known address shall be sent by first class mail, postage prepaid, to the owner of record.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Miami-Dade Florida Form 888, keep away from glitches and furnish it inside a timely method:

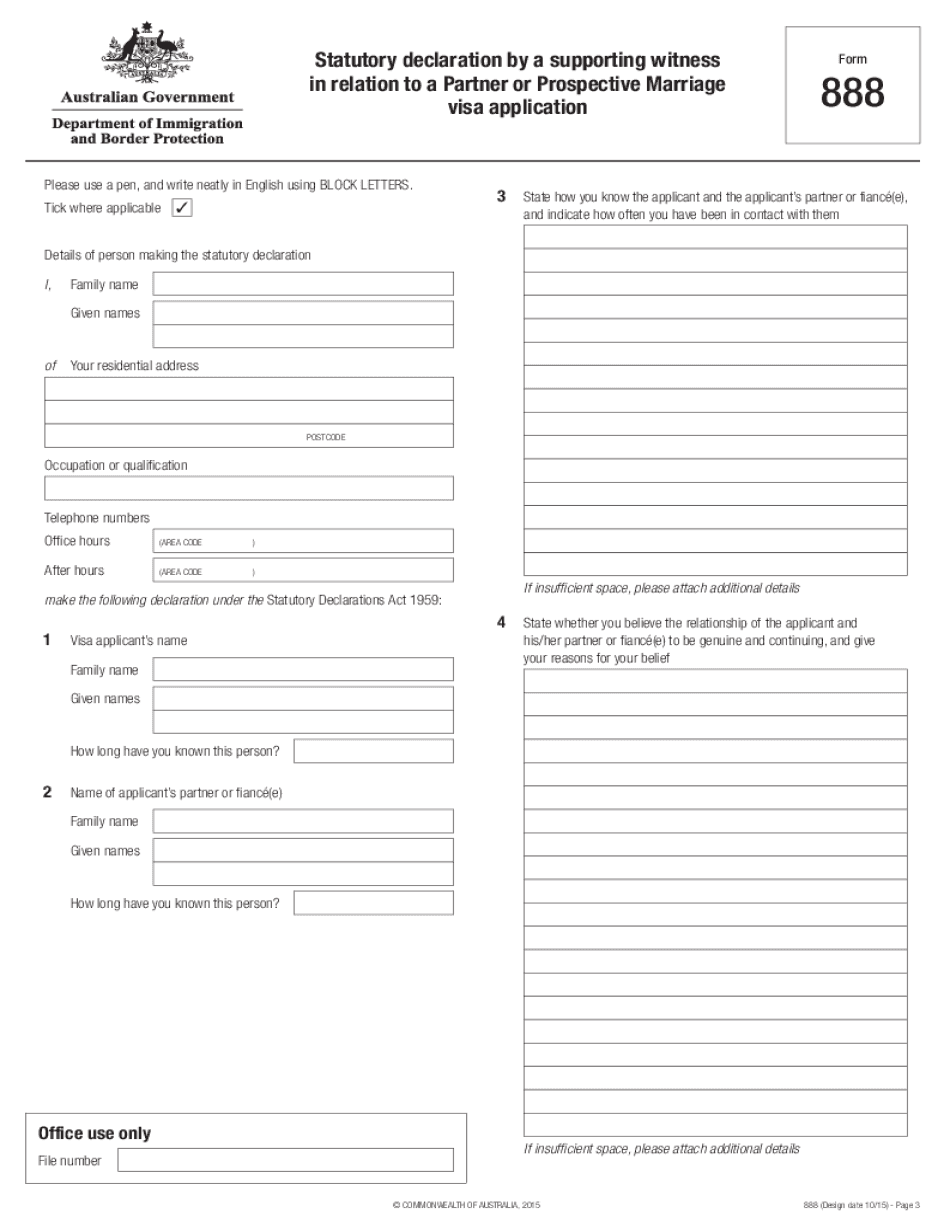

How to complete a Miami-Dade Florida Form 888?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Miami-Dade Florida Form 888 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Miami-Dade Florida Form 888 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.