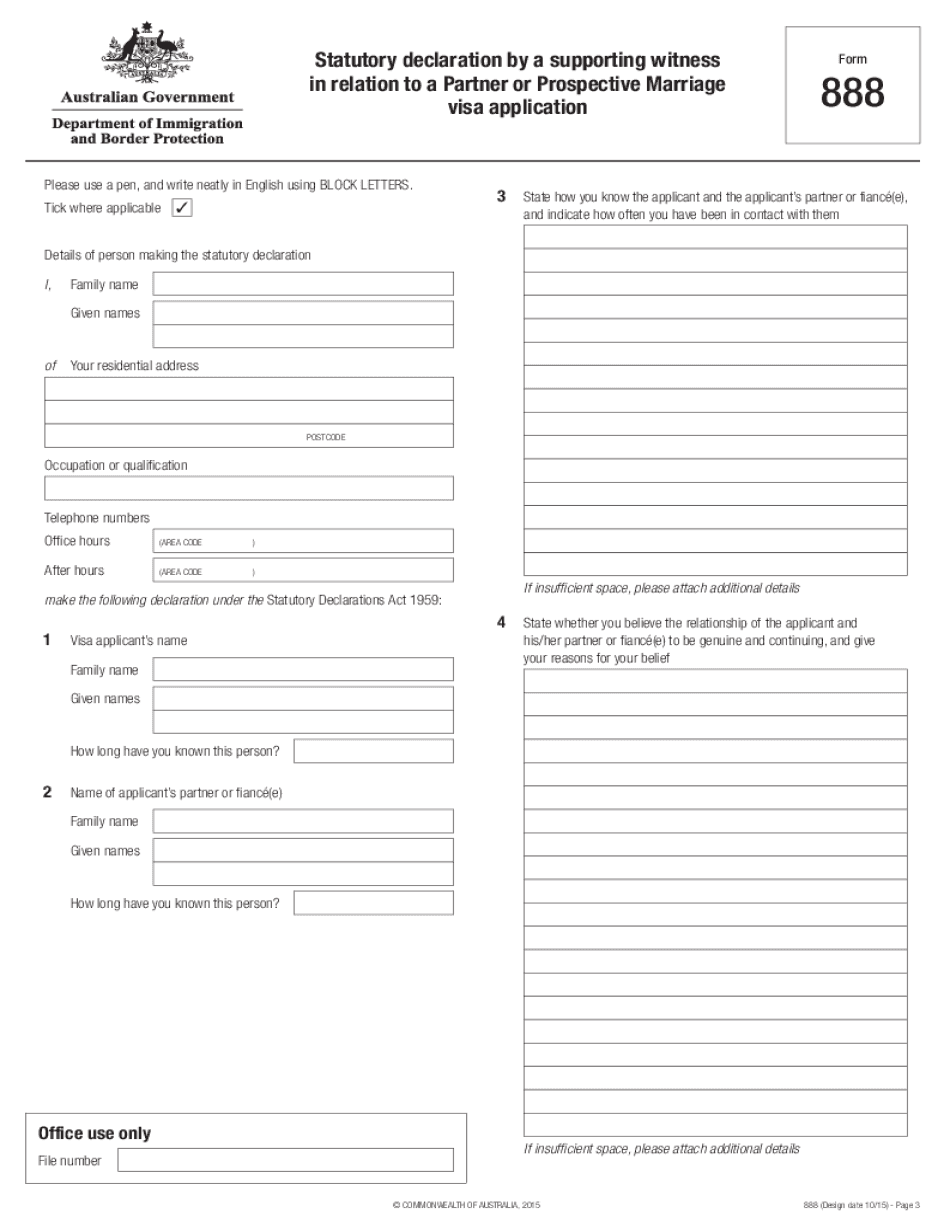

Hey welcome back to Australia immigration times today we're diving into a crucial aspect of the partner visa application process a form 888 statutory declaration if you were in the process of applying for a partner Visa understanding the ins and outs of this form is vital stick around as we break down everything you need to know to fill it in correcty section one what is form 888 and why is it important a the significance of form 888 so what exactly is form 888 well it's a statutory declaration essentially a written statement of facts to be completed by friends and slash or family of the call its purpose to provide a comprehensive view of your relationship showcasing not only its social aspects but also confirming that your loved ones actn knowledge and support your un this is gold when it comes to establishing the authenticity of your relationship section two who should complete form 888 a applicability across border if your friend or family member is an Australian citizen or permanent resident using form 888 is a no Brer but what if they are overseas no worries they can complete an equivalent statutory declaration in their home K section three the weight of the document illegal ramifications and witness requirements now it's essential to understand that this isn't just a casual dockin making false statements in a statutory declaration can lead to fines or even imprisoned also the Declaration must be witnessed by specific individuals including doctors government officials or legal practitioners section four navigating the form 888a understanding the format and specific questions the form 888 follows a set format with specific questioned it's crucial to note that any one completing it must be at least 18 years old and preferably an Australian citizen or permanent...

PDF editing your way

Complete or edit your form 888 anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export 888 form directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your form 888 pdf as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your form 888 partner visa by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

Award-winning PDF software

How to prepare Form 888

About Form 888

Form 888 is a form used by people who want to provide information about Australian visa applicants to the Australian Department of Home Affairs. The primary purpose of this form is to let the department know about the genuine relationship between the applicant and the person who is providing the information. Form 888 is especially helpful when the visa applicant is in a de facto relationship and needs to prove that they have a genuine and ongoing relationship. In general, anyone who is willing to provide information about the visa applicant's relationship with them needs to complete Form 888. This may include friends, family members, colleagues, and even neighbors. Form 888 is required for most types of Australian visa applications, including partner visas, family visas, and some skilled visas.

What is form 888?

Form 888 Statutory Declaration is important for an Australian resident or permanent resident in the event she or he is going to be a witness to a relationship between the visa applicant and his or her partner. The individual needs to be at least 18 years old and be aware of visa applicant and his or her partner enough time. In case this individual isn't a permanent citizen of Australia the template does not have any value.

The Department of Immigration and Citizenship should trace the entire way of a relationship to prevent the possibility of fictitious matrimony registration as a way to obtain Australian citizenship. That's why it is important to request a witness to confirm a relationship. The individual selected with this matter ought to fill in the Statutory Declaration.

This form template doesn't need any additional supporting documents. It could be created during the process of the applicant's visa formalization.

Here you may find the list of the required information to fill in:

Personal information;

The industry of employment, occupation;

Visa applicant's name| and the name of his/her partner;

The most full specifics of their connection;

Remember to sign the form right after its finalization. Print the papers to deliver or forward it online straight to the Department of Immigration and Citizenship.

Online options assist you to arrange your papers administration and strengthen the productiveness of one’s work-flow. Stick to the quick guide in order to fill out Form 888, avoid mistakes and supply it within a properly timed way:

How to finish a 888 form?

- On the website with all the forms, click Start Now and move to the editor.

- Make use of the clues to complete the essential areas.

- Provide your individual details and contact information.

- Make sure that you enter correct details and numbers in suitable fields.

- Meticulously examine the text of your form together with grammar and spelling.

- Go to the support part if you have any issues or ask our Support team.

- Set an electronic signature in your Form 888 with the help of Sign Tool.

- When the form is completed, push Done.

- Deliver the ready form through the use of electronic mail or fax, print out or keep for future in your gadgets.

PDF editor enables you to make modifications to your Form 888 through the internet connected device, personalize it based on your requirements, sign it in electronic format and deliver in numerous ways.

What people say about us

How you can submit templates without mistakes

Video instructions and help with filling out and completing Form 888