Award-winning PDF software

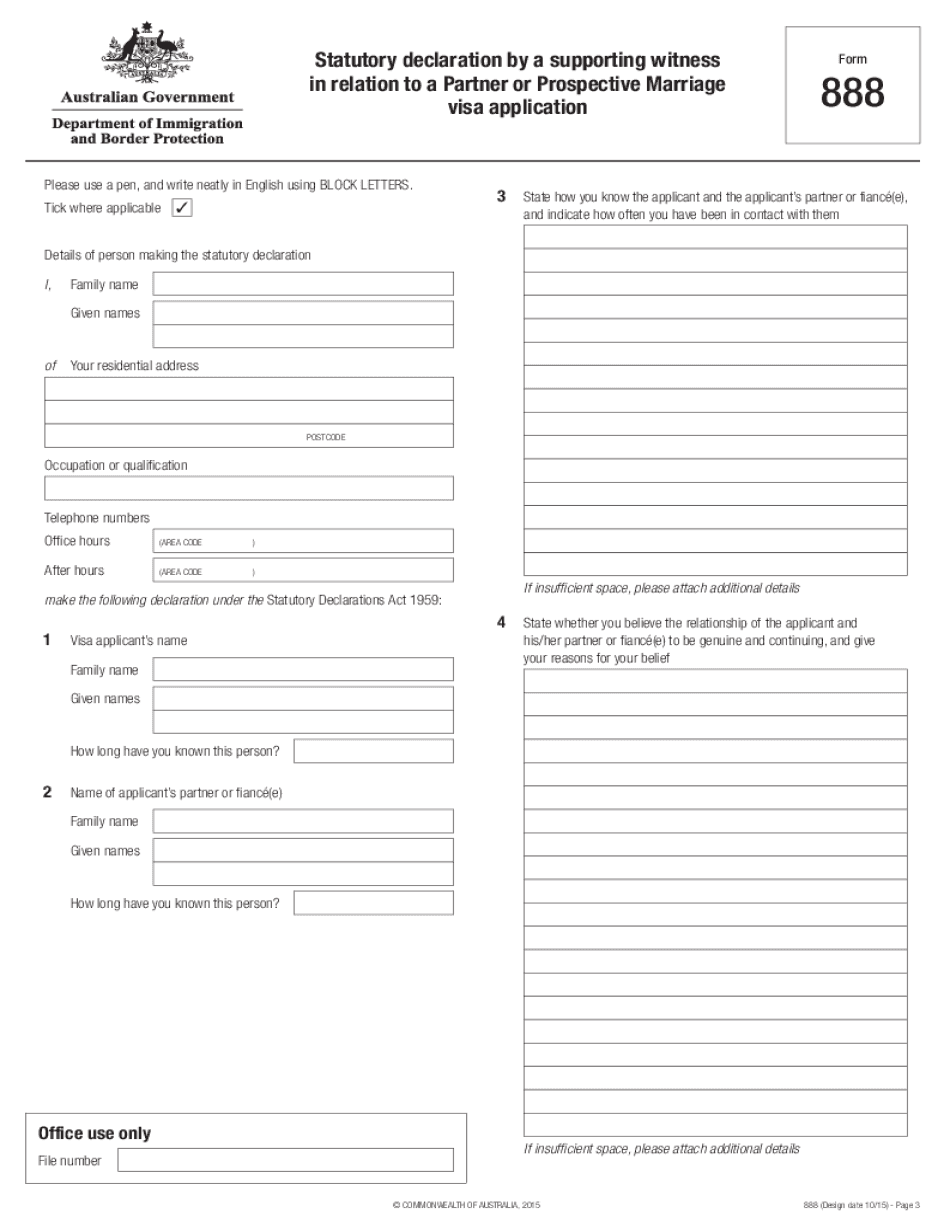

Alabama Form 888: What You Should Know

We also offer financial counseling May 18, 2025 — Mortgage assistance is available for first time homeowners to pay their mortgage-related expenses. We do not provide assistance with debt, other financial problems, such as rent or maintenance costs for your home. You must be able to provide your own transportation. We may be able to provide financial assistance with a home equity loan, or homeownership grant. May 30, 2025 -- Mortgage assistance programs in the state of Alabama are provided on a sliding scale that may offer up to 90 percent of the value of the loan at 1%, 3%, or 5 percent interest. Mortgage Assistance Alabama (MAY) can help first-time homeowners with mortgage-related expenses, up to 12 monthly mortgage payments, and other forms of mortgage assistance. May 2025 — The Housing Assistance Program (HAP) is available to help provide low-income, disabled residents with mortgage assistance to pay their monthly mortgage loan payments. We may also provide information about government and community resource agencies helping with paying the mortgage. You may apply at. Mortgage Assistance Alabama (MAY) can help first-time homeowners with mortgage-related expenses, up to 12 months of mortgage payment, and other forms of mortgage assistance. May 19, 2025 — Homeowner's Insurance Program (HIP) is another tool available to help homeowners with mortgage-related expenses. We help with homeowner's insurance premiums as well with assistance to pay other expenses such as the payment of medical co bills, utility bills, and other bills. May 1, 2025 — The Homeowners' Counseling Program (HCP) at the Legal Service Agency will work with applicants to help them pay their home insurance premiums. May 19, 2025 — The Community Resources and Community Revitalization (CRC) Program at the Alabama Legal Services Agency is focused on the prevention and intervention of foreclosure, providing mortgage assistance to low- and moderate-income homeowners and homeowners with low- and moderate-income families that have lost their homes through foreclosures and other nonpayment of mortgage payments.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Alabama Form 888, keep away from glitches and furnish it inside a timely method:

How to complete a Alabama Form 888?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Alabama Form 888 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Alabama Form 888 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.